In the previous articles we looked at synergy and ways to use it. In this article we will discuss how to calculate the value of synergy.

As explained in the intro article the value of synergy was originally illustrated through two horses pulling weight. While a draft horse on its own can pull about 8,000 pounds two draft horses working together can move about 24,000 pounds! Not 2x, but three times as much. If the horses are trained together this can amplify to 32,000 pounds. That is up to 4x. This is applicable to M&A where close collaboration of the two entities can yield significantly better results. The following diagram provides an example view of the value of standalone entities vs. the combined entities.

Calculating synergy In the business world is much more complicated and involves not only accurate evaluation of current status, but also forecasting the future states.

The calculation is about estimating the synergy value over the expected realization time period. In this post we will delve into factors to consider to calculate the synergy effect over time.

Component view

In the following section we present a framework for calculating the value of synergy over time based on a component view. This framework can be used to guide strategic and tactical decisions in partnerships or acquisitions.

Eventually every synergistic relationship will turn into an equilibrium over a period of time; referred to as the realization period.

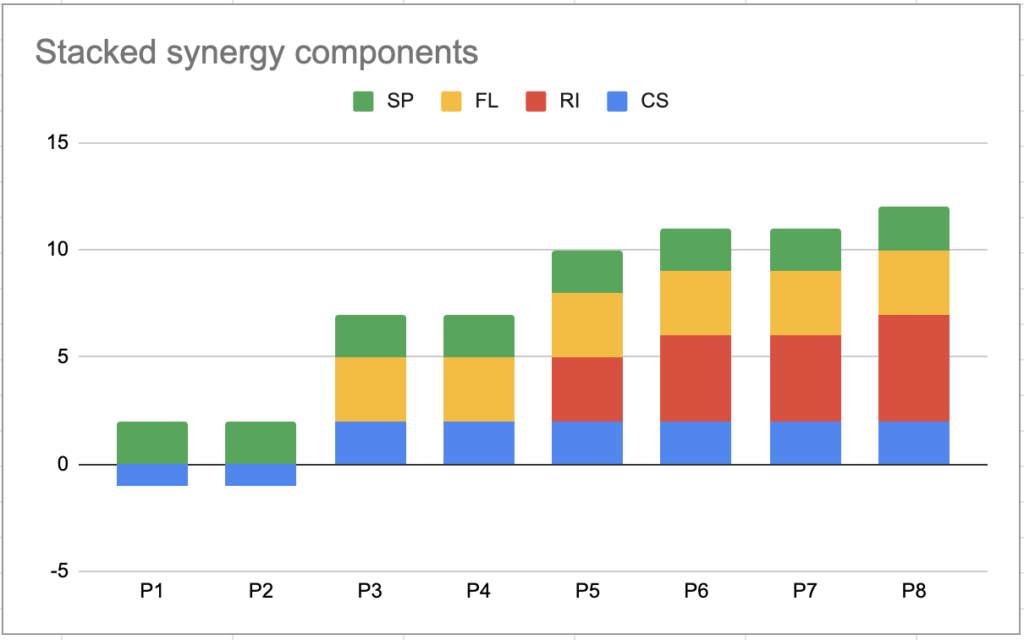

In this framework we look at synergistic benefits as four individual components and calculate the total value of synergy as the aggregate value over such a time period.

The four components we look at are:

- Cost Saving (e.g. headcount, production saving, ..)

- Revenue Increase (e.g. cross sell, upsell, new channel, ..)

- Financial Leverage (e.g. cost of capital, borrowing power, tax benefits, .)

- Strategic Power (see below)

Eventually every strategic support will help with financial gains. However there are reasons to look at them separately, especially if the relationship is not direct.

Examples:

- Barrier to Entry (IP, Parent, .. )

- Brand/Trust power

- Competitive presence

- Compliance and regulatory

- Domain knowledge and expertise

There are several factors that could cause each of the components to have negative or positive effects at different points during the realization period.

We refer to negative synergies as synergy antagonism. Examples of such antagonism effects are:

- Cultural mismatch

- Morale and retention impact

- Management distraction

- Integration overhead

- Compensation and benefit gaps

Taking antagonism and strategic factors into consideration can help you do a more effective planning to exploit the benefits.

Applying these concepts over the four components of synergies yields the following formula:

Over realization period

Synergy(t) = [CS(t) + RI(t) + FL(t) + SP(t)]

Take for example the revenue increase as a piecewise function of time:

t = Q1 -1M

RI(t) = {

t > Q1 3% YOY

Functions CS(t), FL(t) and SV(t) can be defined using a similar model.

It is normally the case that negative synergies tend to appear near term after an acquisition but it is likely that an acquisition exhibits such effect long after a deal closes.

This can be applied to all synergies to get an overall effect over time and make tactical and strategic decisions that yield the best return on investment.

A more advanced method of calculating synergy will take into consideration the probability of achieving each of the components.