M&A

The highway to growth

Introduction

The business world is obsessed with growth. To thrive, a company has to grow. Companies that grow slowly face difficulty attracting and retaining talent and drawing the interest of investors. As financial market and investors demand more aggressive growth, hitting targets on time becomes challenging. Companies counter this demand with one or more business growth strategies, the most common of which are:

- Market Penetration – Gaining market share with the same product, within existing market (new channels, roll-up, etc.)

- Market Expansion – Selling current products into new markets (also called market development)

- Product expansion – Expanding offerings with complimentary products and add-ons sales

- Diversification – Selling new products to new markets

In that context, making a decision to grow organically or through M&A is of great importance, since the acquisition process demands expertise and resources that can consume valuable time, attention and money from the core business. These competing demands may impact organic initiatives.

On the other hand, M&A creates lucrative opportunity for a corporation if executives can manage the intricacies of the process. In other words, rapid growth from acquisitions can create a great return on investment, which increases shareholder value in a short span of time. It can also help a buyer outperform competition and gain additional market share. If organic growth becomes elusive, M&A becomes a must.

In this article we assert that organic means are only a preferred option up to a certain growth level and beyond that fail to provide the agility that the industry demands. In contrast, M&A is a practical approach to gain faster access to products, technology, talent and expansion to new geographies. Furthermore, acquiring the right target can also fuel the organic efforts by closing gaps and accelerating development.

M&A Space and impact

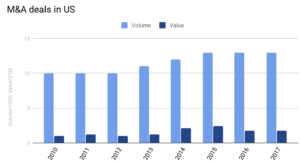

The value of worldwide M&A deals amounted to 4.74 trillion U.S. dollars in 2017, comprising nearly 51,000 transactions. 1

Studies have shown that successful serial acquirers grow 3 times faster than their rivals and deliver nearly double the shareholder returns of their peers over a sustained 15-year period. 2

For instance, ADP has been yielding 20% compounded annual return to shareholders with their M&A strategy.3 Another perfect example is Inuit, where about 80% of revenue is result of acquisitions. 4

It is not surprising that there has been a year over year upward trend in growth through M&A as corporations see M&A as enabling high returns. 5 Nearly 69% of US corporation CEOs plan to drive growth through M&A. 6

Moreover, besides direct revenue goals, M&A is being used as an effective means to accelerate innovation and support organic efforts. That is important at a time when fear over losing technological and competitive edge has nearly increased 3 fold among CEOs. 7

M&A is also widely used as a transformation strategy. 2016 was the first year in which the number of tech companies acquired by companies in other sectors exceeded those acquired by other tech companies, according to Bloomberg data. 8

Organic vs. inorganic

Synergies with acquired businesses are one commonly accepted reason for grown through mergers and acquisitions, some of the benefits of M&A are not directly measurable. To name a few:

- Getting access to a talent pool that has the domain knowledge, work well together, and have established processes; all at once

- Execution risks associated with implementation, technical challenges, market validation, positioning, messaging, pricing, etc.

- Faster and more predictable time to market

- Accelerating organic efforts by closing gaps in resources and capabilities

- Boosting support in areas where the company may be underperforming

- Eliminating competition

Despite the fact that majority of these factors support the decision to expand through M&A, some of the other factors that concern executives are:

- Fear of choosing a poor or not the best target

- Higher initial cost, insufficient cash

- Fear of overlooking major due diligence items

- Fear of paying too much for the deal

- Insufficient resources to execute on the deal

- Finally, additional complexities due to the need to manage numerous players in the process

We have discussed these challenges in various blogs. Please refer to our web site for information and recommendations on how to overcome these concerns. In the rest of this article we present a hypothetical example of a new product introduction through organic growth means and contrast it with acquiring the same product through M&A.

Case Study – Build vs. Buy

The following example exhibits the potential benefits of acquiring a product vs. building it. It involves a very rudimentary analysis of time and risk. However, many other factors come into picture and have been omitted here for simplicity.

Implementation of a new product requires initial time spent securing people with the right expertise and other resources. Let’s call this, resourcing time. We must also consider a failure rate (talent risk) in securing resources on time that have the right profile (character, commitment, expertise, etc.). This yields an effective talent development time (Ttalent). Let’s call the cost of this phase Ctalent.

Further assume a product takes a number of months to develop. Let’s call this implementation time. With a failure rate (implementation risk) in meeting the timeline and dealing with unknowns or technical challenges. This yields the effective product development time(Tproduct). Let’s call the cost of this phase Cproduct.

Continuing, assume a product takes a number of months to establish in the market. Let’s call this market development time, with a risk factor (market risk) and trials to find the right positioning, messaging, and product/market fit. This yields effective market entry time (Tmarket). Let’s call the cost of this phase Cmarket.

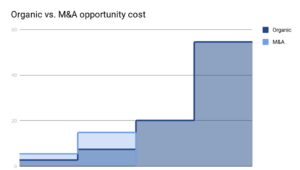

In addition to extra development risk and delayed revenue, there is also an “opportunity cost,” which includes competitive position and loss of market-share to other players. Importantly, the size of opportunity cost will grow bigger as time passes. Let’s call this Copportunity.

On the contrary M&A benefits from the element of surprise as it doesn’t give sufficient time to competitors to react and strategically neutralize the efforts.

The combination of the stated costs and risks can be presented in the following formula.

Overall cost = ( Ctalent + Cproduct + Cmarket ) * Copportunity

We assume a product that takes n years to develop with n/2 for talent acquisition and n/2 for marketing. Let’s also assume 22n exponential opportunity cost.

As it is shown above an organic effort could result to 4.1 times more overall unrealized revenue than an acquisition. Adding this up over the entire region between organic and M&A yields the following chart:

Challenges

Many smaller companies may have decided that M&A is not an option or is too big of an undertaking for their strategy map. The main reason is that, unlike larger companies, they may not have access to cash resources and cannot tolerate deal errors. However, even mid-range companies have options to approach M&A without access to a huge cash flow. Please refer to our article on Cashless Acquisition, which articulates several acquisition options that do not require current cash.

Furthermore, lack of experience and insufficient committed resources makes the decision to acquire another business one of the most difficult that the CEO and executive staff can make. Board members may also be tasked with these difficulties. Across the board, company executives are concerned about the complexity and risks as well as the impact it could have on the core, because it requires internal resources that could potentially affect the normal operation.

Traditionally companies engage consultants and investment bankers. However, these costly options may provide insufficient support. In addition, external resources such as these may be incentivized by closing the deal rather than ensuring its success. Focus on closing alone leaves integration and real value realization up in the air. This could very well explain why, historically, only 30% of the deals realize the values management desires. 9

Leading an in-depth study of M&A, Synrgix has designed a solution that not only addresses the M&A challenges for active players but also makes M&A possible for all companies seeking growth; by coupling a smart software platform with a suite of on-demand services, we offer the easiest path for growth.

Conclusion

M&A can be one of the most favorable paths to grow and to meet ever increasing shareholder expectations of market agility. This does not mean giving up on organic growth, but rather supplementing it. CEOs who have made acquisitions successful, have been able to do so by stimulating organic growth in the businesses they buy.

There are many misconceptions surrounding M&A. Deals can be big or small. Companies that have stable business but perhaps not as much in the bank as is needed to complete an acquisition have cash-free options. Furthermore, internal deal teams that may only be required sporadically can be supplemented with external support. With current solutions that provide support ranging pipeline management through post-merger integration, companies can manage the resources needed to successfully undertake acquisitions.

Finally, with the assistance of current technology, companies can manage the complexity of the process in order to increase efficiency and lead to better deal outcomes. By keeping the focus on strategy and results through the slog of detailed activities needed to complete and integrate acquisitions, with full transparency through their organizations, companies can reach their M&A growth goals more successfully.